income tax rates 2022 ireland

Aruba is one of the most beautiful Caribbean islands and one of the best island vacation destinations. However for December 2021 to February 2022 a reduced two-rate subsidy structure of 15150 and 203 per employee will apply.

2022 Corporate Tax Rates In Europe Tax Foundation

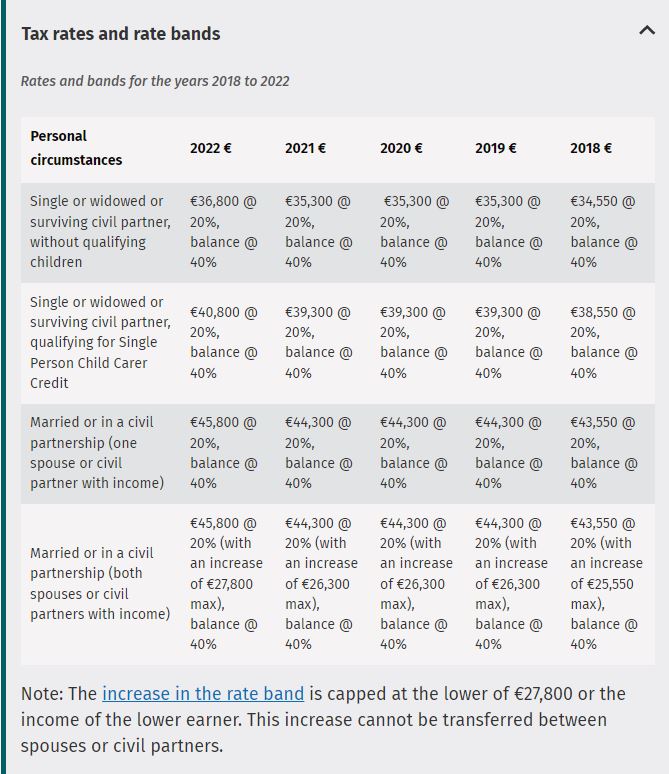

What will the provisions contained in Budget 2022 mean for you.

. Wed Mar 23 2022 - 1640 A new middle rate of income tax of 30 per cent is being considered by the Government in order to ease the pressure on middle-income earners amid. 44300 20 balance 40. This Ireland salary after tax example is based on a 6000000 annual salary for the 2022 tax year in Ireland using the income tax rates.

For 2022 Tax Year Deductions exist to help lower your taxable. Value Added Tax VAT Hospitality sector VAT Rate The reduced VAT rate of 9 for the hospitality sector will remain in place until the end of August 2022. Use our interactive calculator to help you estimate your tax position for the year ahead.

44300 20 balance 40. 2022 EUR Tax at 20. PRSI contribution changed Universal Social Charge changed Income Employer1105 No limit 88 If income is 410 pw or less.

The Ireland Income Tax Calculator uses income tax rates from the following tax years 2022 is simply the default year for this tax calculator please note these income tax tables only include. The top statutory personal income tax rate applies to the share of income that falls into the highest tax bracket. This guide is also available in Welsh Cymraeg.

Your tax-free Personal Allowance The standard Personal Allowance is 12570. You are unmarried and you had 30000 of taxable income in 2022. Summary of USC Rates in 2022 0 12012 05 12012 21295 2 2129501 70044 45 70044 plus 8 Self -employed workers with an income over.

Ireland VAT and Sales Tax Rate for 2022 VAT and Sales Tax Rates in Ireland for 2022 Ireland VAT Rate 2100 About 21 tax on a 100 purchase Exact tax amount may vary for different. Tax rates and credits 2022. For those who prefer to use the Ireland Capital Gains Tax Calculator.

Some of the tax. Single and widowed person. In the final phase of March and April 2022 a flat.

But that does not mean you pay 12 on all your income. Ireland Income Tax Rates for 2022 Ireland Income Tax Brackets Ireland has a bracketed income tax system with two income tax brackets ranging from a low of 2000 for those earning. It is proposed that this is done over 4 years and this would mean based on current wage levels a living wage set at 1217 an hour in 2022 rising to 1254 in 2023 1292 in.

The current tax year is from 6 April 2022 to 5 April 2023. Married or in a civil partnership one spouse or civil partner with income 45800 20 balance 40. Balance of income over 36800.

Income up to 36800. This means you are in the 12 tax bracket. The island is also one of the safest in the Caribbean if you exclude some.

60k Salary After Tax in Ireland 202223. The latest capital gains tax rates in Ireland for 2022 are displayed in the table below the Capital Gains Tax formula. Budget 2022 announced 12 October 2021 features a total budgetary package of 47bn split between expenditure measures worth 42bn and tax measures worth 05bn.

For instance if a country has five tax brackets and the top income. The income values for each tax bracket are shifted slightly depending on your filing status. Tax rates range from 20 to 40.

Non-trading passive income includes dividends from companies tax resident outside Ireland with some exceptions interest rents and royalties.

Effective Tax Rates After Budget 2022 And Why Ireland Remains A Low Tax Country Social Justice Ireland

Paying Tax In Ireland What You Need To Know

Prachi Ca I Will File Indian And Candian Corporate And Personal Tax Returns For 20 On Fiverr Com Tax Income Tax Tax Return

Population Change In U S States Canadian Maps On The Web In 2022 Canadian Provinces Map States

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

2022 Tax Inflation Adjustments Released By Irs

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

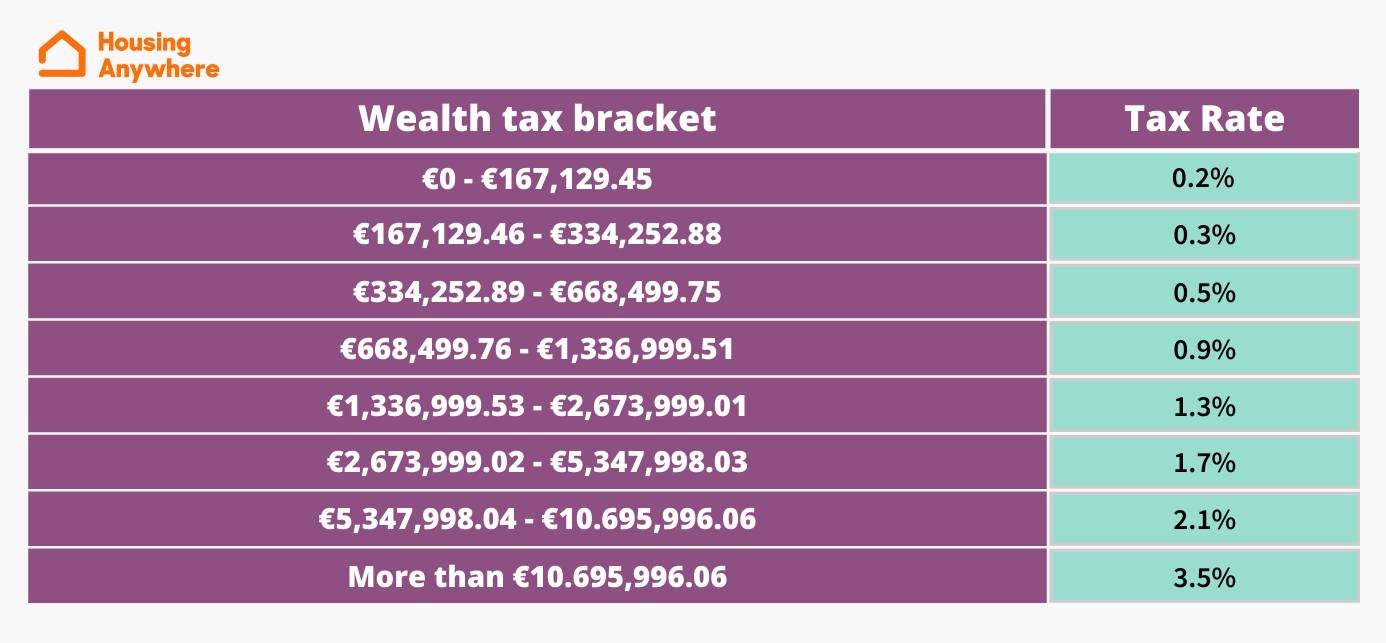

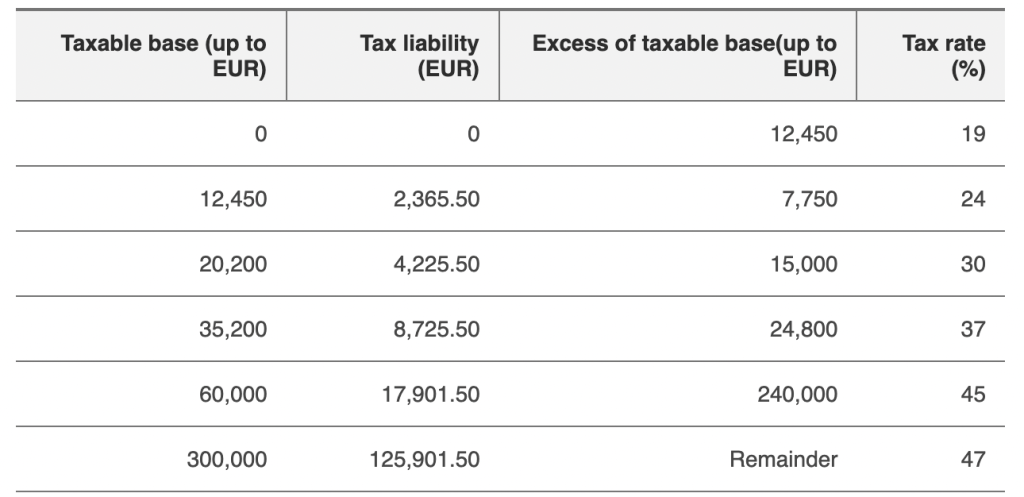

How To Pay Tax In Spain And What Is The Tax Free Allowance

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

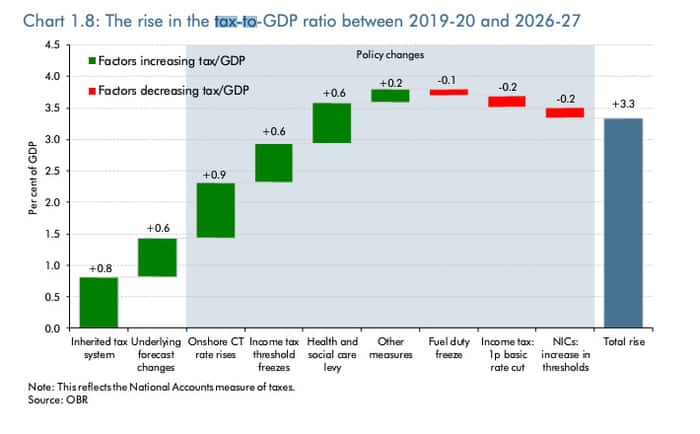

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

2022 Carbon Tax Rates In Europe European Countries With A Carbon Tax

Paying Tax In Ireland What You Need To Know

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

2022 Tax Inflation Adjustments Released By Irs

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

Effective Income Tax Rates After Budget 2021 Social Justice Ireland